Bad payer lists and their effects

For many accountants and finance specialists, the stack of unpaid invoices is a common sight. One that makes their job harder and their partners’ cashflows slower. Regardless of company type or size, late payments have always been an issue for AP and accounting – one that ends up costing time, money, and reputation.

These delays are not only detrimental to your supply chain. They can also affect business reputation and credibility. Worse, they can hurt your brand brand on the long-term. How? By getting your company’s name on a dreaded bad payer list.

What are bad payer lists? They’re lists imposed by European governments in order to highlight companies that pay late. Their main goal is to help calculate the impact of these delays on the economy. But this is not their only purpose. Certain countries such as France, a leader in electronic invoicing and e-procurement, have taken these lists further. They are now using the lists to directly encourage digital transformation, in accordance to European legislation.

Aside from creating financial discipline, such lists also show late payments are an issue for companies of all sizes, including large and financially-secure enterprises.

In 2019, late payment fees totaled 18 375 900€

While corporate myths might have you think otherwise, the truth is the law is pretty clear about what a late payment is. In the case of France, any payment that exceeds 60 days from the day of the invoice or 45 days after the month’s end (article L.441-10 of the French Commercial Code) counts as a late payment. A few products or services are exempted, but the most common goods are not.

Unfortunately, the fines are just as clear as the law’s provisions: 75 000 euros for physical persons and a maximum of 2 million euros for legal persons. The amount can easily double if the breach is repeated within two years from the first sanction. You can even use this official calculator to see how much you owe.

This is the reason why, in 2019 alone, the late payment fines in France totaled no less than 18 375 900 euros, covering both local companies and international conglomerates. Payment delays often reached 25 days, according to Atradius. Because of that, France’s objective by 2021 was to reduce late payment delays to a maximum of 10 days.

Obviously, appearing on a bad payer list can have multiple negative consequences:

- Cashflow loss, due to the fines but also due to having to pay multiple invoices at the same time

- The loss of confidence from both existing and future suppliers

- An overall loss in reputation, on your market segment

- Greater difficulty to get credit or apply for supply chain financing

And that’s just the buyer side of the issue. Suppliers are just as harmed by late payments, with an UK study showing that buyers often pay small and medium suppliers last. The effects? 50 000 SMEs have to close shop every year due to late payments!

The Good News: it’s not your fault!

By now, the fact that late payments are a serious issue is clear. What isn’t clear is what causes late payments, especially in companies where cashflow is not an issue.

For many companies the main culprit for late payments is poor invoice processing. From non-standardized formats to the impossibility to perform matching, poor invoice processing turns an otherwise simple process into a strenuous task. A task that generates needless paperwork and countless lost hours.

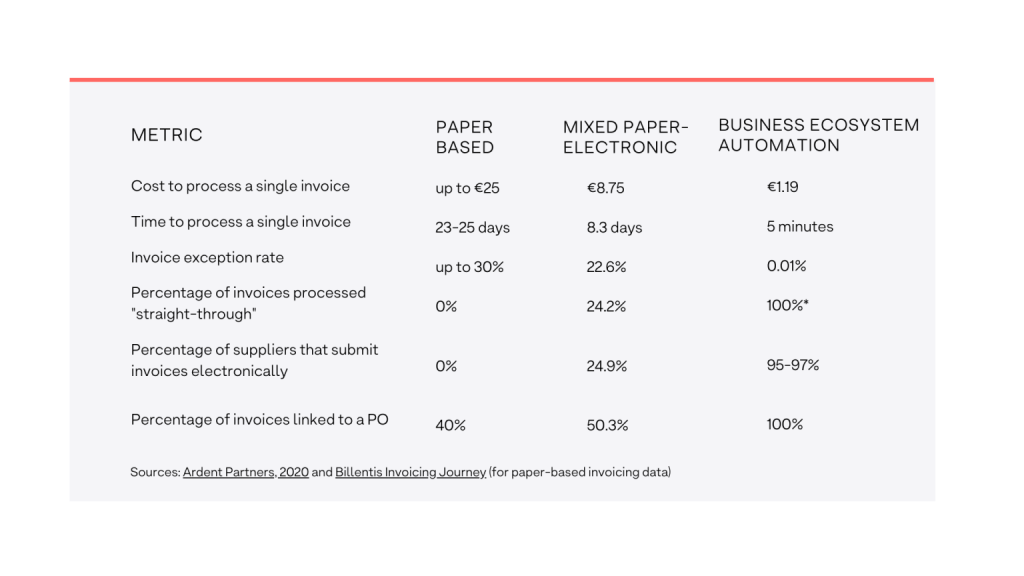

How BEA Automation Stacks Up vs Paper & Mixed Invoice Processing methods

So, while you might have the best intentions towards your suppliers, your manual systems do not. The good news is that by merely automating your P2P process, you will be able to better manage your suppliers and forget about late payments. Not to mention the improved accuracy and compliance. And the best part? Your company’s name will never be on the bad payer list ever again!

Want to know more about automating your P2P and managing payments? Download this free DAF Mag guide and see how French companies tackled the issue!